Redefining Law for aDecentralized World

At the intersection of law, technology, and governance —

Esquare Legal empowers innovators shaping the future of finance.

Ensuring every client decision is legally sound, strategically aligned, and globally scalable

Esquare Legal was born from a simple realization: emerging technology needs equally agile law.

Traditional legal systems weren’t designed for decentralized economies — so we built a firm that speaks both languages: law and code.

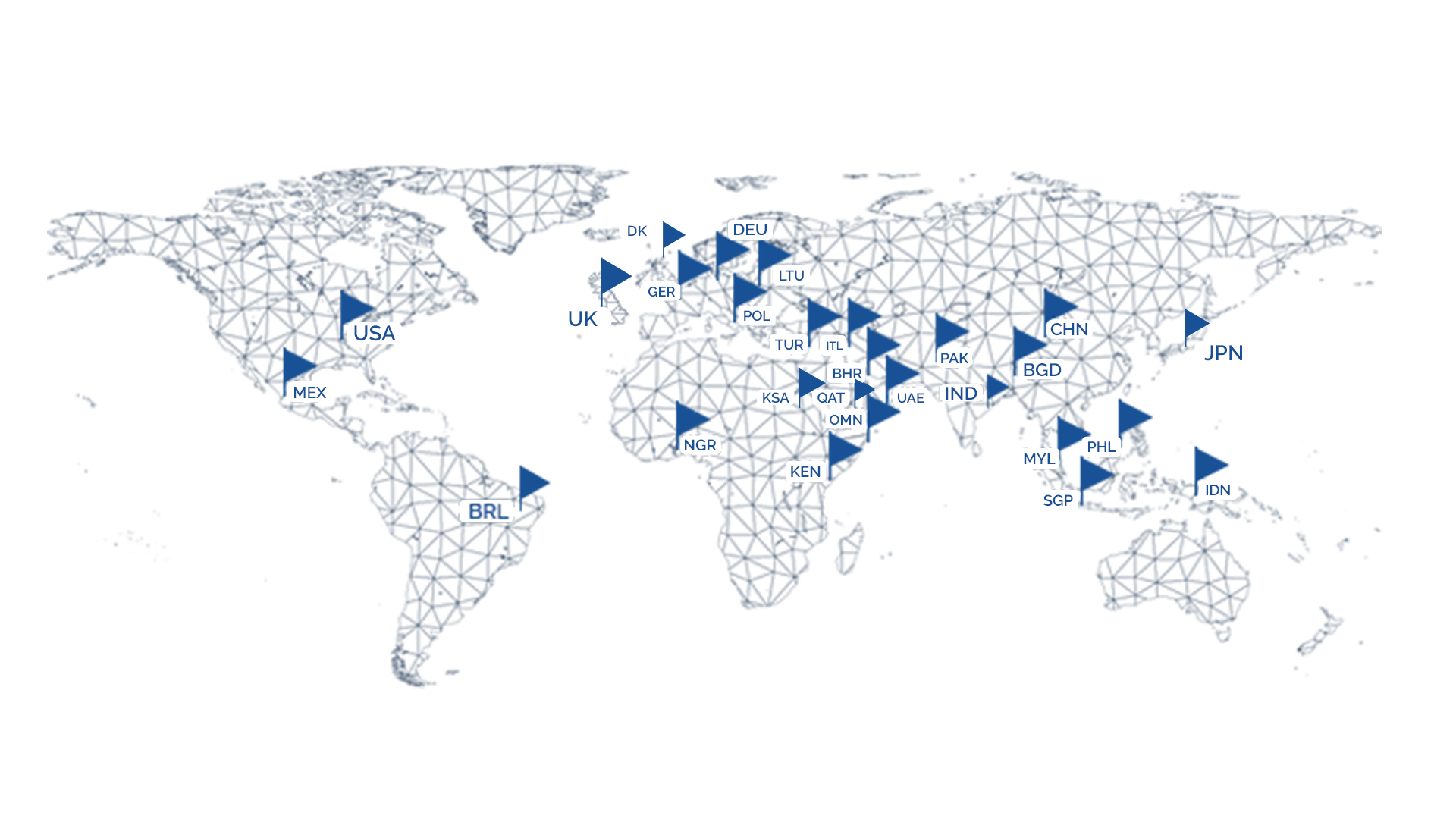

From token launches to global compliance programs, our lawyers combine the judgment of top-tier law firms with the velocity of startup operators. Today, Esquare Legal serves clients across Europe, the Middle East, LATAM, Asia, and the US, advising on crypto licensing, tokenization, governance, and cross-border corporate mandates.

“Justice will not be served until those who are unaffected are as outraged as those who are.”

Benjamin Franklin

Crypto-fluent, globally minded, and built on trust

Our Mission

Empower innovation in the digital economy by engineering legal frameworks that are compliant, credible, and growth-aligned. We solve hard problems at speed without compromising on quality or durability.

Our Vision

Be the preeminent global partner for blockchain and fintech leaders—measured by outcomes, trust, and policy impact. We aim to set the standard for embedded, product-aware legal counsel in emerging tech.

What Makes Us Different

We’re crypto-native, not crypto-curious — deeply embedded in our clients’ ecosystems, advising daily on strategy, product, and growth.

Crypto-Native, Not Crypto-Curious

We work inside client workstreams as true team members, advising daily on product, tokenomics, governance, growth, and risk—not just documents. This embedded model delivers speed, context, and measurable outcomes.

End-to-End Token Launch Leadership

We design legal architectures that withstand regulatory scrutiny, align with exchange requirements, and support sustainable economics—from whitepaper to listing to secondary market conduct and ongoing disclosures.

Global Coverage with Local Depth

We advise across the EU, Middle East, LATAM, and Asia, including US-facing considerations, translating complex regimes into clear execution pathways. We coordinate with trusted local counsel where needed.

Productized Legal

We package recurring needs into predictable programs, led by senior counsel and enabled by legal tech, so clients get Tier-1 judgment with startup-speed execution.

Specialized Divisions

Division 1: Web3 Division

Token launches, listings, DeFi architectures, staking and liquidity programs, and DAO governance. We advise protocols, platforms, and consumer-crypto builders on compliant growth.

Division 2: China Division

Cross-border advisory for Chinese and PRC-linked clients. We bridge China-to-Middle East, China-to-LATAM, and China-to-Africa mandates with cultural fluency and legal precision.

Division 3: Corporate Division

Multi-jurisdictional structuring, venture financings, M&A, restructurings, governance frameworks, and enterprise risk management. We handle billion-dollar mandates and early-stage structuring alike.

Division 4: Think Tank

Research and advocacy at the intersection of emerging tech, geopolitics, and security. We publish on CBDCs, token governance, terrorism finance, and tech rivalries—shaping policy and accelerating adoption.

Representative Results

Our track record reflects both legal precision and commercial impact.

Europe — RWA Tokenization & Listing

Guided a leading platform from pre-launch to listing — aligning legal, tokenomics, and market strategy to achieve a 10× revenue increase.

Europe & US — Gamified Earnings Platform

Advised on US expansion and Tier 1 exchange listing for a top gamified earnings platform.

Pakistan — USD 4.2 B Infrastructure Project

Counsel to Chinese investors on Pakistan’s largest urban development — designing governance and risk frameworks.

Middle East & Africa — Restructuring

Led a multibillion-dollar restructuring for a design and engineering group — aligning tax, governance, and operations.

Middle East & SE Asia — VARA License

Secured a VARA license for a major exchange, enabling GCC and Southeast Asia expansion.

Germany · India · UAE — Cross-Border Litigation

Achieved strategic wins across multiple jurisdictions in complex dispute cases.